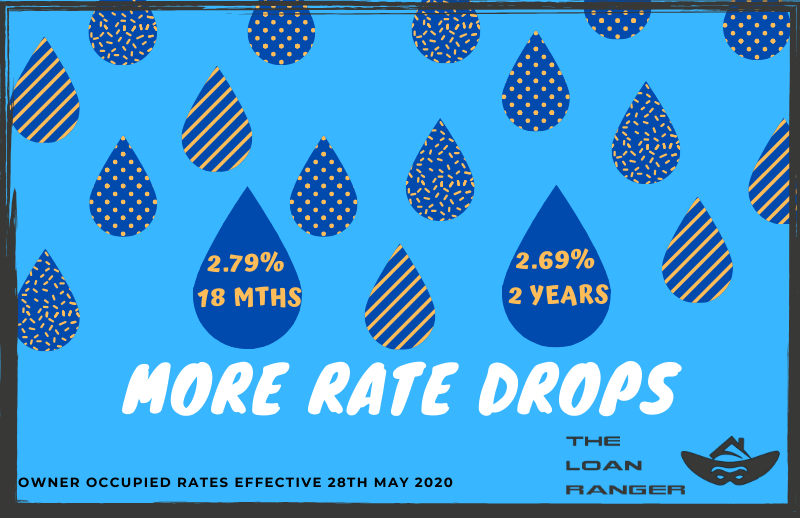

May 28

The rates keep falling for BNZ! BNZ have again made changes to some of their home loan fixed rates following the rate reductions made by The Co-Operative Bank New Zealand.

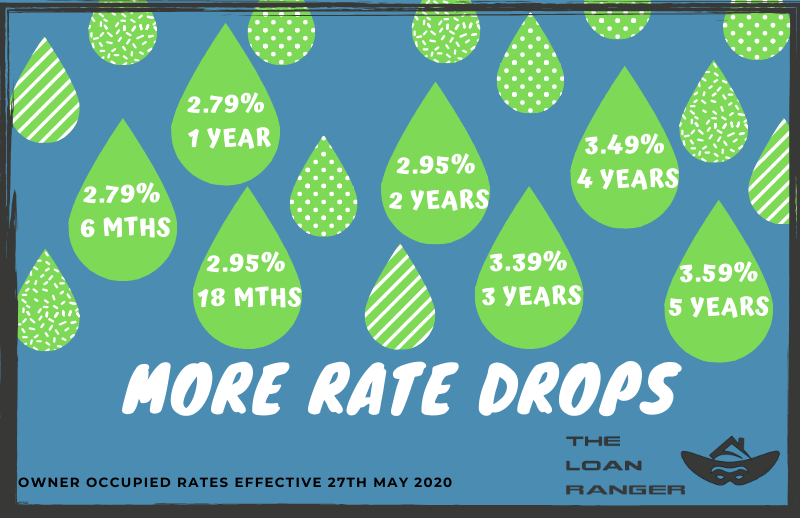

May 27

On the back of the home loan fix rate changes made by BNZ, ASB, Kiwibank and Westpac New Zealand. Today The Co-Operative Bank New Zealand have made sweeping changes across their home loan fix rates.

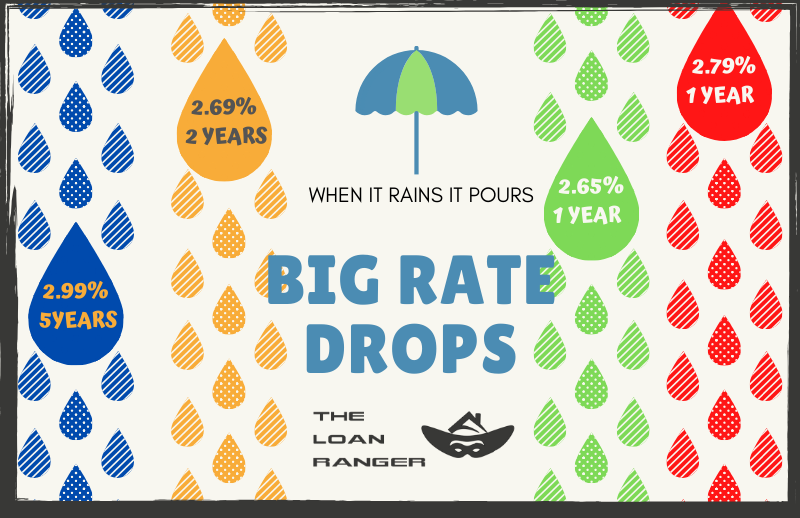

May 25

BNZ, ASB, Kiwibank and Westpac New Zealand have reduced some of their fix rates. The biggest change comes from Kiwibank, currently offering a very low 2.65% for 12 months!

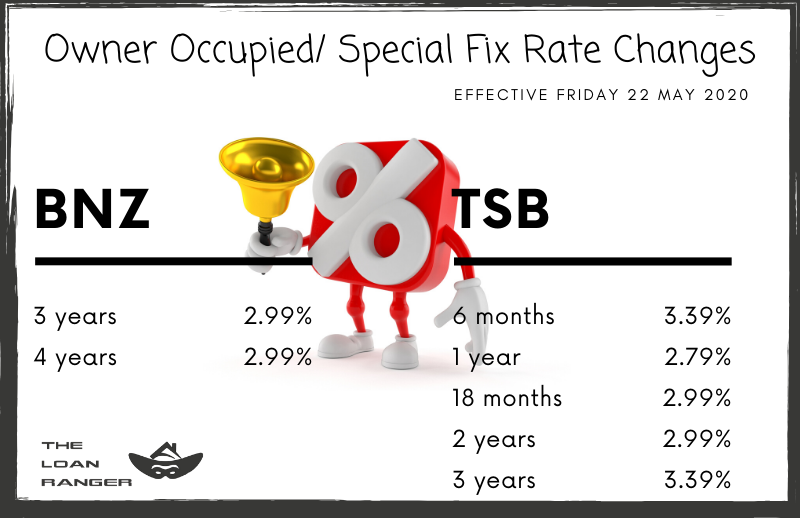

May 22

On the back of ANZ New Zealand rate changes yesterday, TSB NZ and BNZ have amended their advertised rates..and dont they look good! Expect more banks to follow.

May 21

One of the big NZ banks is currently offering a VERY HOT rate! The Reserve Bank have been recently calling for banks to lower rates and ANZ has met this call.

May 15

Great to see another bank changing their home loan fix rates. BNZ is the latest to join the sub 3% club with notable absences by The Co-Operative Bank New Zealand and SBS Bank.